8 new schemes to give impetus to flagging eco

Tuesday, 29 June 2021 | PNS | New Delhi

Health, tourism get spl attention of additional Rs 1.5L cr package

Finance Minister Nirmala Sitharaman on Monday announced eight new schemes involving Rs 1.5 lakh crore of additional credit facility to provide a helping hand to the sectors worst affected by the restriction imposed under the Covid-19 lockdown across the country. Health and tourism sectors have drawn special attention of the FM. The Government also extended benefits from the free foodgrain programme for unprivileged people till November.

Under the news schemes, the Centre would extend a federal guarantee on bank loans to healthcare sector while waiving visa fees for 500,000 foreign tourists to perk up tourism.

Together with previously announced Rs 93,869 crore spending on providing free foodgrains to the poor till November and additional Rs 14,775 crore fertiliser subsidy, the stimulus package — mostly made up of Government guarantee to banks and microfinance institutions for loans they extend to Covid-hit sectors — totalled up to Rs 6.29 lakh crore.

Addressing a press conference, Sitharaman said, “Economic relief measures are being announced today.”

She provided Rs 23,220 crore of additional funding for setting up children and paediatric care/paediatric beds at hospitals to prepare healthcare infrastructure to deal with any emergency arising for Covid wave hitting children.

To incentivise job creation, the Government is committed to paying the employer and employee’s share to provident fund (PF) for all new recruitments done till March 2022. Previously, the Government paid Rs 902 crore for 21.42 lakh beneficiaries of 79,577 establishments.

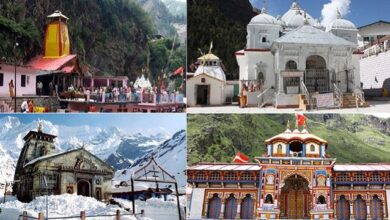

With the tourism sector being hit hard by the pandemic, she announced up to Rs 10 lakh loan to tourist agencies and Rs 1 lakh loan to tourist guides while waiver of visa fee for the first 5 lakh foreign tourists visiting India after travel restrictions ease.

Tourist visa fee waiver will cost the Government Rs 100 crore.

Other announcements included an additional Rs 19,041 crore for providing broadband internet cover to all village panchayats, an extension of tenure of production linked incentive (PLI) scheme for large scale electronics manufacturing by a year and Rs 88,000 crore of insurance cover for goods exporters.

The support measures were announced as states start lifting restrictions after new coronavirus infections showed a decline. The economy seems to be on a recovery path after being hit by a devastating second wave of infections that was dubbed as the world’s worst Covid-19 surge.

Sitharaman said the Emergency Credit Line Guarantee Scheme is being expanded Rs Rs 4.5 lakh crore from Rs 3 lakh crore. Under the scheme, a collateral-free loan is provided by banks to small businesses and the government stands guarantee for any default.

The ECLGS, launched last year, has helped cash-starved small businesses raise funds during the Covid-19 lockdown for working capital and to meet their orders. As much as Rs 2.73 lakh crore has been sanctioned under the three previous ECLGS programmes, of which Rs 2.10 lakh crore has already been disbursed.

Another Rs 1.1 lakh crore loan guarantee scheme for Covid-affected sectors was announced. This included Rs 50,000 crore for the health sector, with a three-year single loan of Rs 100 crore carrying an interest of 7.95 per cent. Loans to other sectors such as tourism and hospitality would come at 8.25 per cent per annum interest rate.

Also, micro-finance institutions will extend 25 lakh small borrowers loans of up to Rs 1.25 lakh at an interest rate that is 2 per cent lower than the benchmark lending rate, she said.

The government also extended the loan guarantee programme to the tourism sector, after last month widening it to airlines and hospitals.

Financial Services Secretary Debasish Panda said the objective of credit guarantee is to encourage banks to lend to enterprises so that they get credit at low cost. The measures announced Monday

are “to ensure money comes into hands of small, medium and large enterprises,” he said.

The credit programme supplements separate measures announced by the Reserve Bank of India (RBI) last month to boost credit for health care services and provide fresh lending to vaccine-makers.

It provided an on-tap liquidity window for banks worth Rs 50,000 crore to extend credit to health services and vaccine manufacturers until March 2022.

The extension of free foodgrains to 80 crore poor till November will cost Rs 93,869 crore more, bringing the total cost of the programme to more than Rs 2.27 lakh crore, she said.

After the outbreak of the second wave in April 2021, the PMGKAY scheme was reintroduced, initially for May-June and then extended till November this year. The total money spent on PMGKAY will be Rs 2,27,841 crores. Besides, farmers to get additional protein-based fertilizer subsidy of nearly Rs 15,000 crores. To revive the North Eastern Regional Agricultural Marketing Corporation (NERAMAC), the government has announced a package of Rs 77.45 crore proposed for financial restructuring and infusion of funds.

Sitharaman said the estimated financial implication for providing free foodgrains is Rs 93,869 crore for this year. The Centre spent Rs 1,33,972 crore last fiscal on this scheme. The total financial implication is estimated at Rs 2,27,841 crore for PMGKAY, Sitharaman added.

In the wake of the second wave of COVID-19, the scheme was relaunched in May 2021 to ensure the food security of the poor. Then on June 23, cabinet approved the proposal to extend it by five more months till November-end. Under this scheme, National Food Security Act (NFSA) beneficiaries will be provided 5 kg of food grains free of cost until November 2021. This is over and above the distribution of 5 kg foodgrains per person every month at highly subsidised rates of Rs 1-3 per kg via ration shops to NFSA beneficiaries.